The progression of building Applied Research Organizations and how venture capital may be changing science and research development forever

When an area becomes consensus but is still somewhat novel or hard to parse for investors, they often try to distill companies into very clear-cut and easily “findable” metrics in order to make decisions. In many cases, this wave of chaos, rapid change, and complexity pushes investors to retreat into discussing a constant in startups; Founders. And as one searches for Founder-Company...

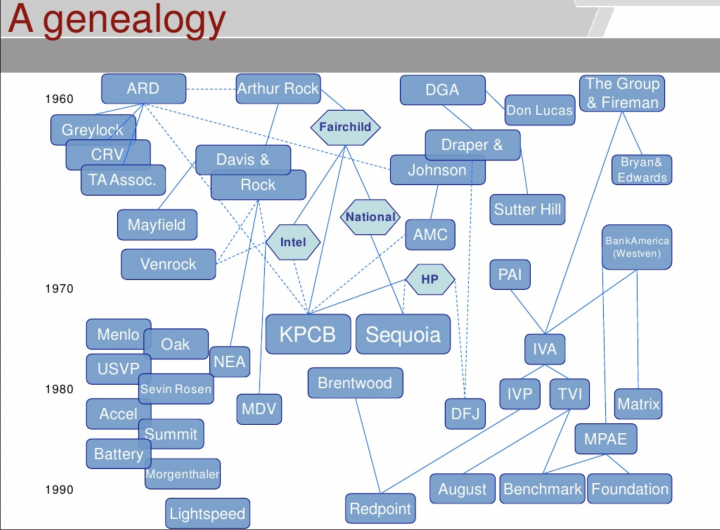

Disclaimer: I believe that unless you are one of a few firms, there is no possible claim that there is a “correct” way to do venture, only to treat people with respect along the way. Venture capital started as a network heavy business and arguably still is to many. I don’t think that is dominant anymore. The Early Days: VC was the ultimate network business Venture capital started as the ultimate...

Recent Comments