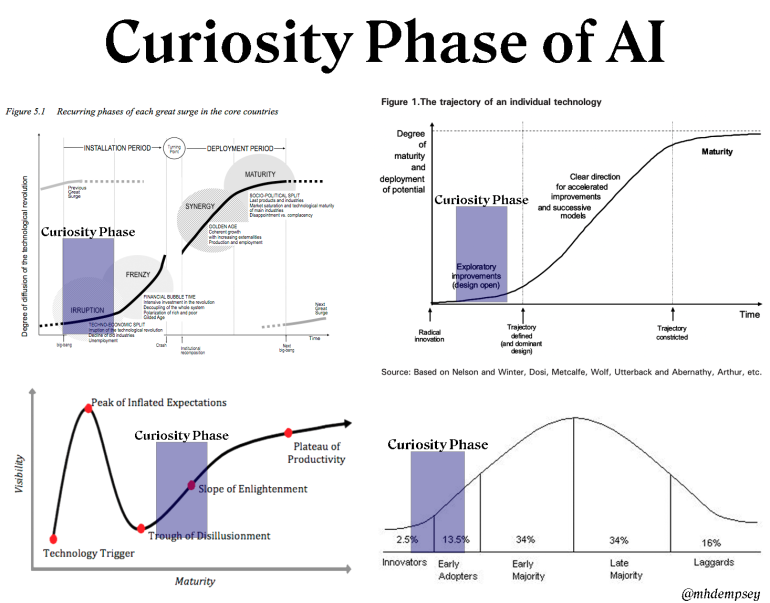

Navigating go-to-market, product, and customers during the most dangerous phase of an emerging category.

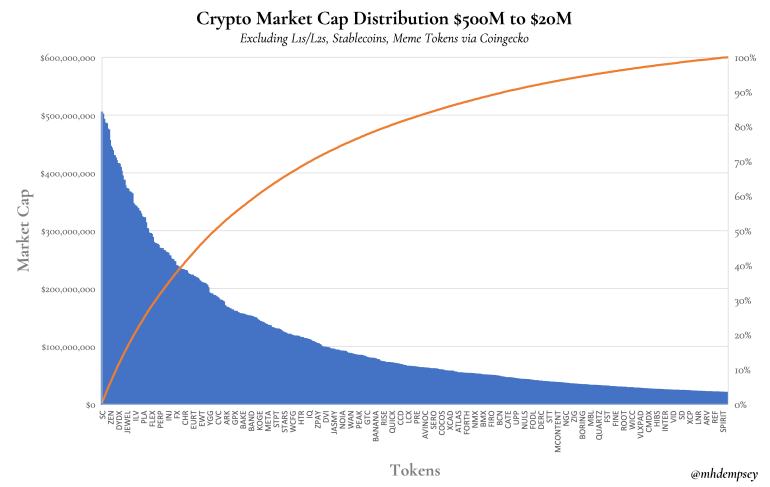

Power laws rule everything around us. This is a core principal of what we have largely come to learn in a world dominated by this narrative, which has also helped proliferate the concept of Asymmetric Upside. Within traditional tech/Web2, due to the compounding nature of moats (most notably network effects) and duopolistic markets, it is often assumed that outcomes follow a colloquial power law...

the greatest trick valley vc's played was to make employees believe their options were worth the tradeoff in present income, lifestyle, liquidity and flexibility of employmentcrypto fixes this— Meta DAOdas (@mdudas) November 7, 2021 There has long been discussion and divisiveness on startup equity in crypto. Most recently signified by Mike Dudas’ tweet above surrounding how crypto...

In technology, the concept and cycles of bundling and unbundling are well-understood. Historically what we have seen is that at very early stages, unbundling occurs, until some early primitives and use-cases are understood, which then results in bundling often due to necessity to level set a user experience or to kickstart true usage. As a given platform matures, unbundling then occurs to...

After spending some time reflecting on 2019, I figured I’d write out these thoughts more for my close friends, and it’s possible at some point I’ll publish an edited version of this without a password. Disclaimer that many of the views expressed below on life come from a specific type of experience both on growing up and of economic status and mobility. My key learnings/top of...

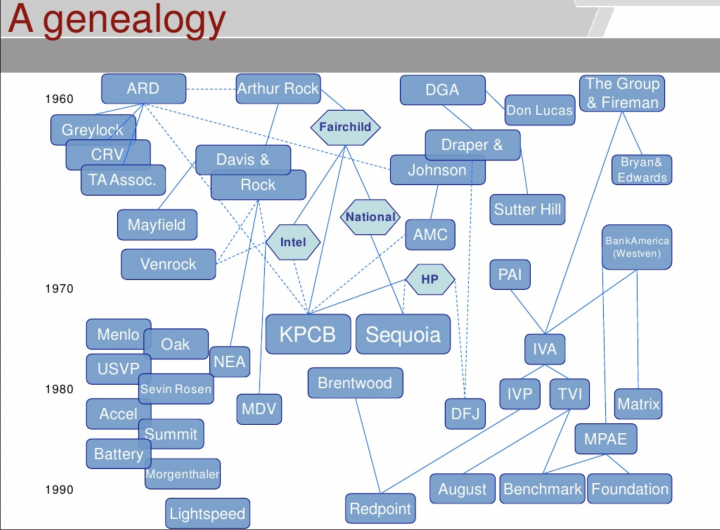

Disclaimer: I believe that unless you are one of a few firms, there is no possible claim that there is a “correct” way to do venture, only to treat people with respect along the way. Venture capital started as a network heavy business and arguably still is to many. I don’t think that is dominant anymore. The Early Days: VC was the ultimate network business Venture capital started as the ultimate...

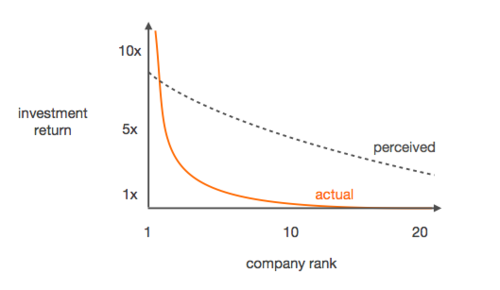

Venture Capital functions with a power law where the majority of a fund’s returns come from a small percentage of investments. Because of this, VCs need to know if a single investment can return the entire fund. As Bill Gurley famously said “Venture capital is not even a home run business. It’s a grand slam business.” This is where the Return The Fund (RTF) analysis comes into play.

Recent Comments